Fill in a Valid New Jersey Cbt 100 Template

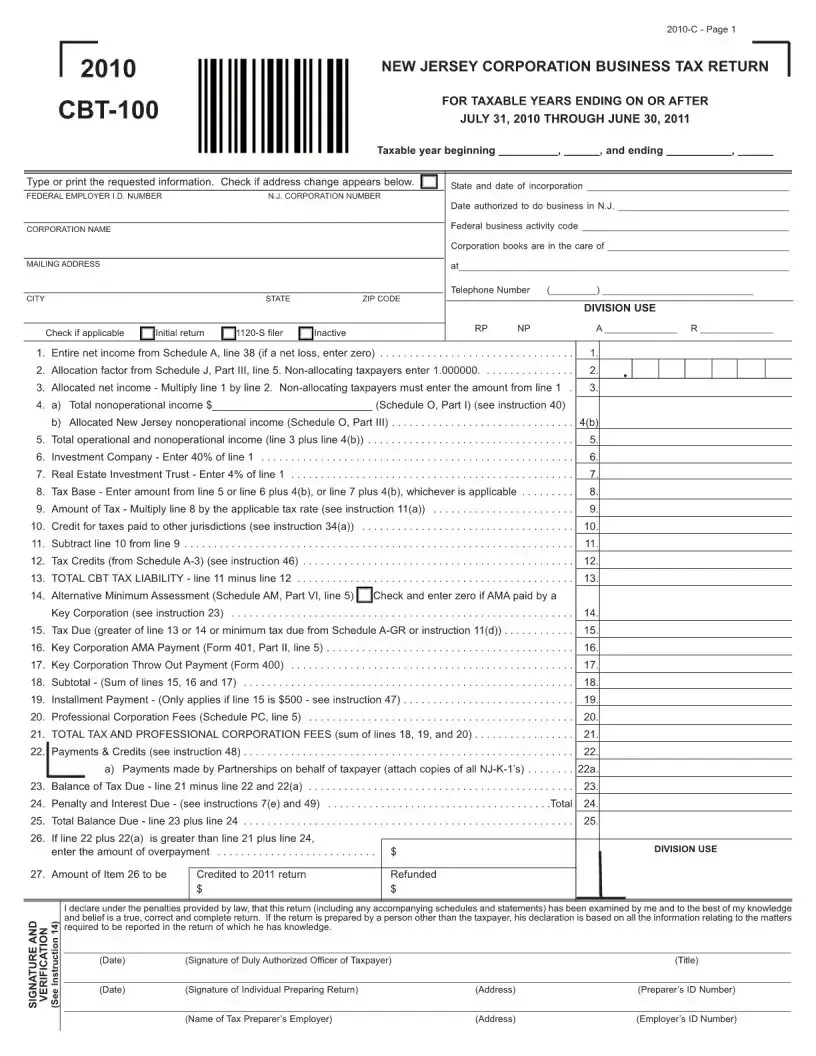

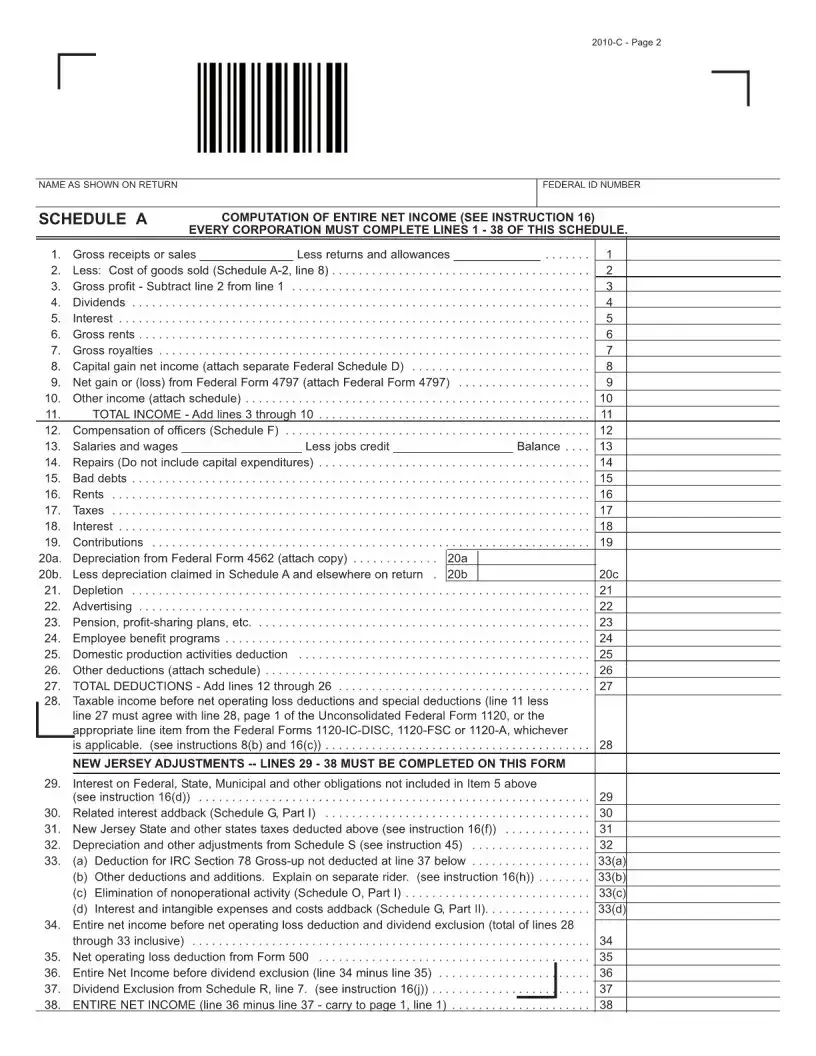

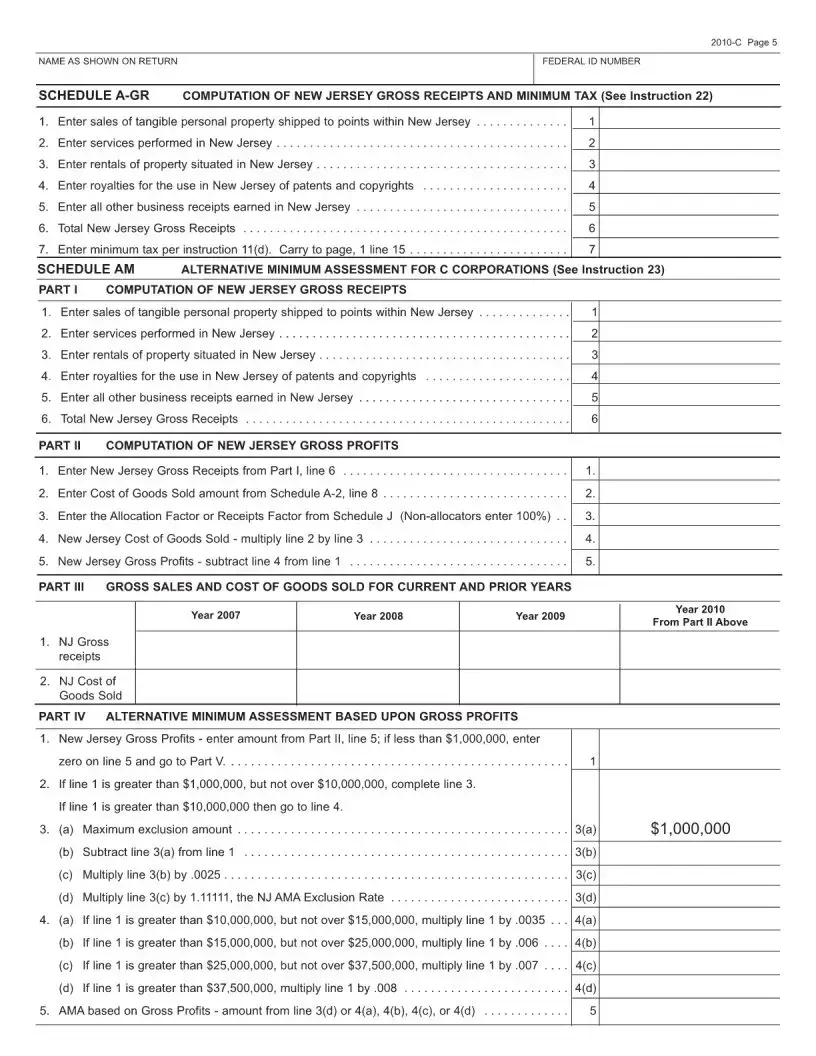

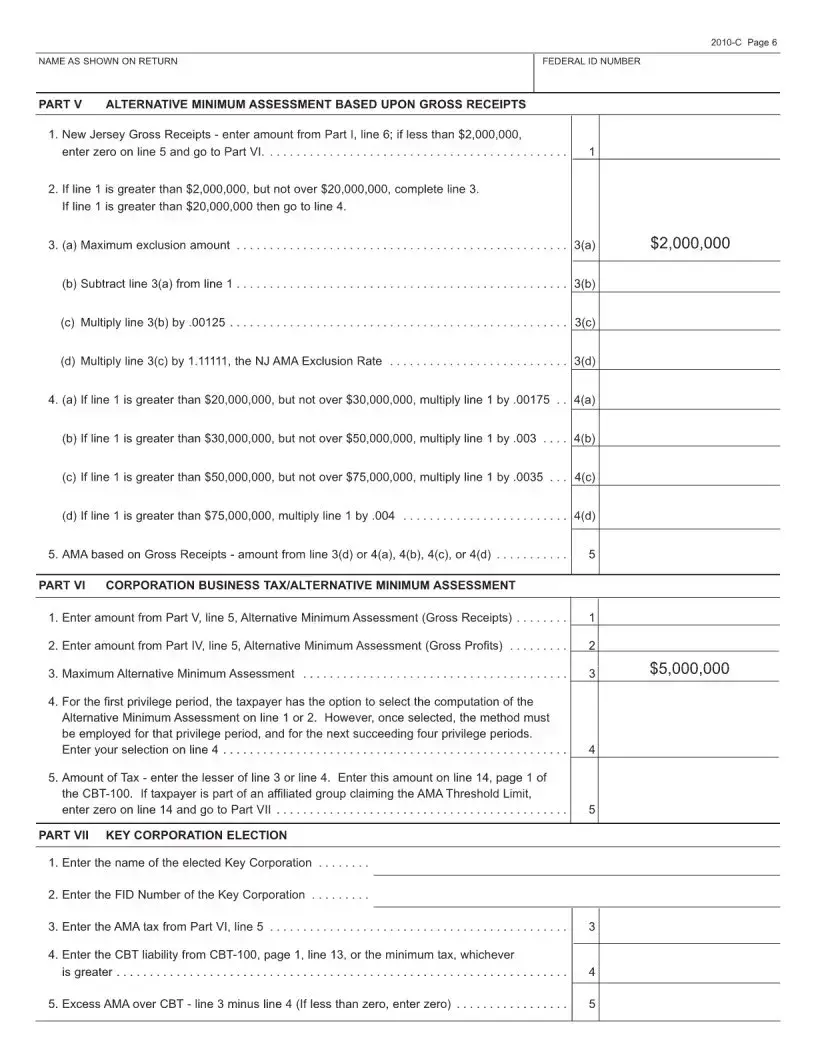

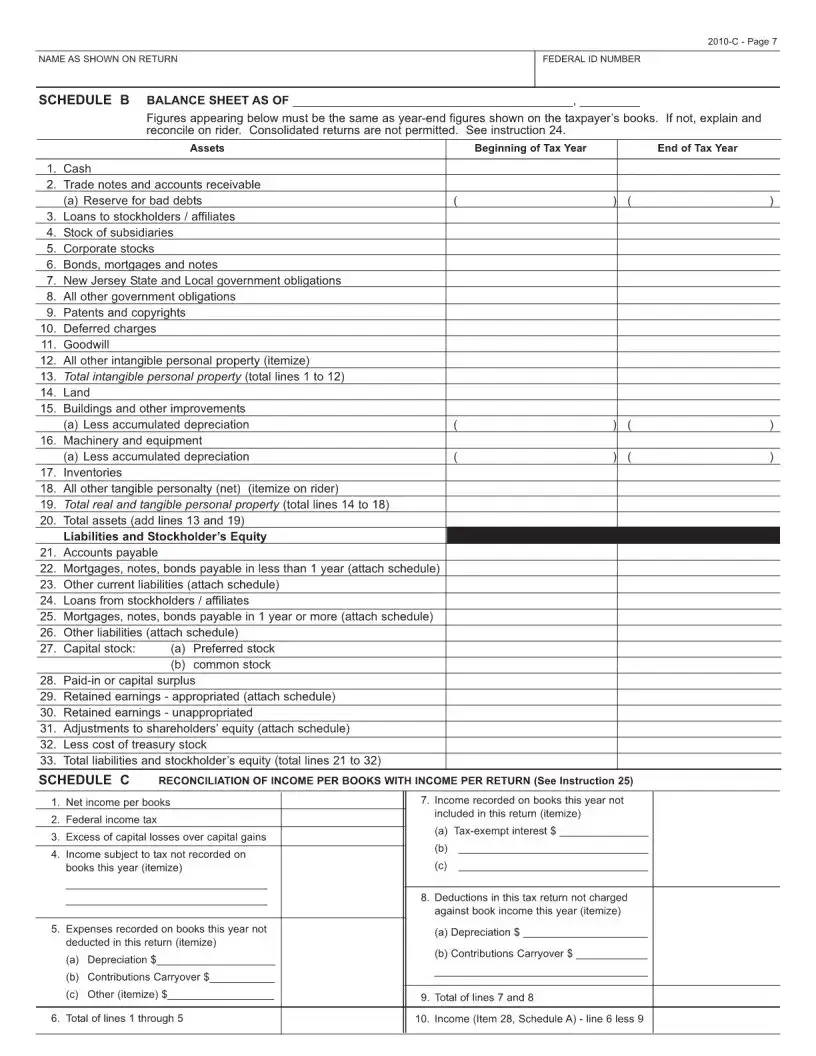

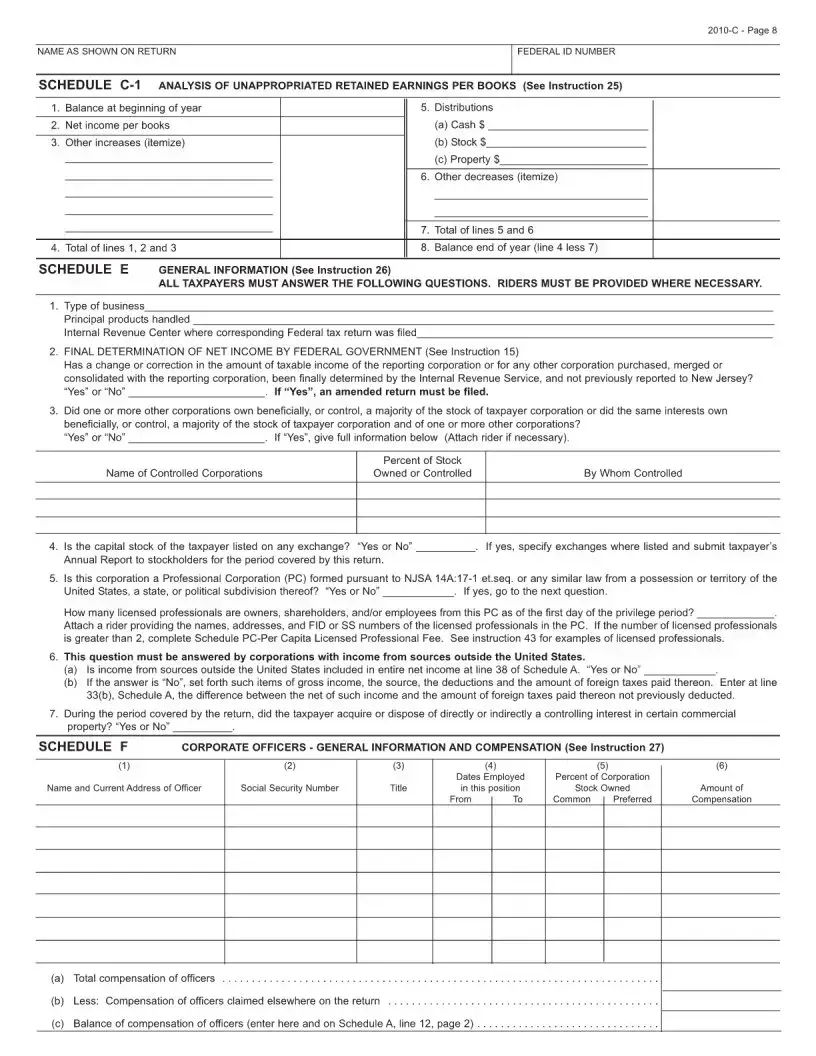

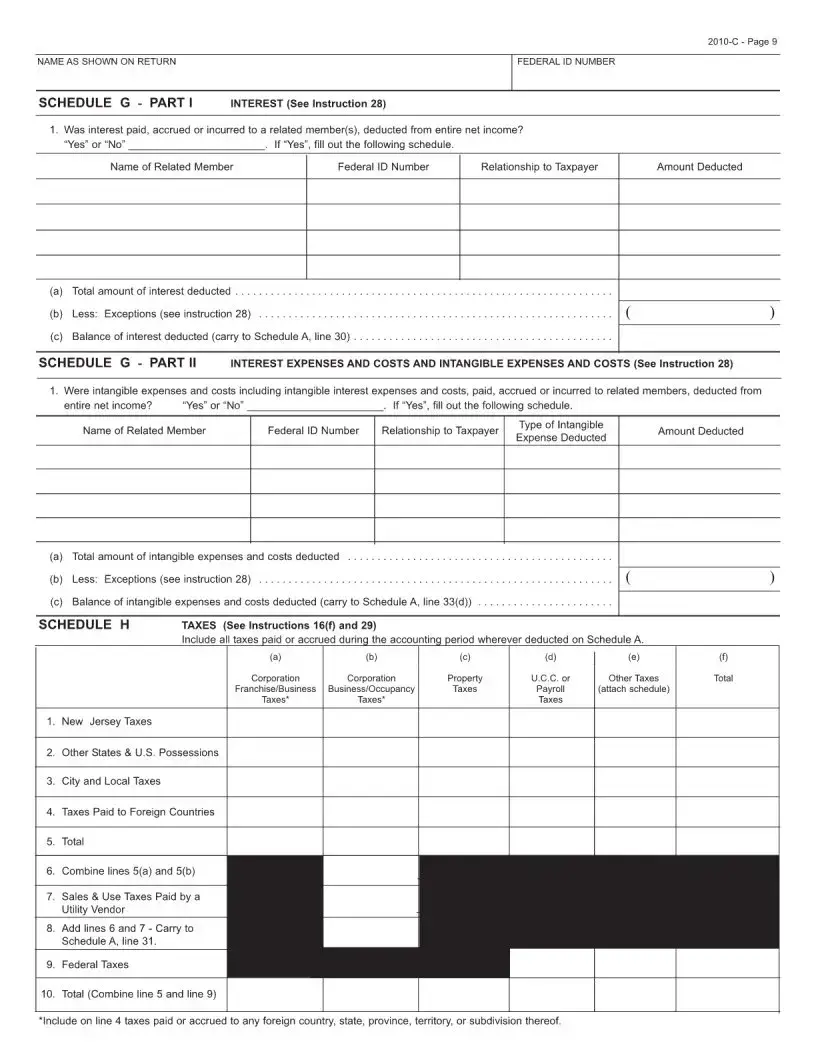

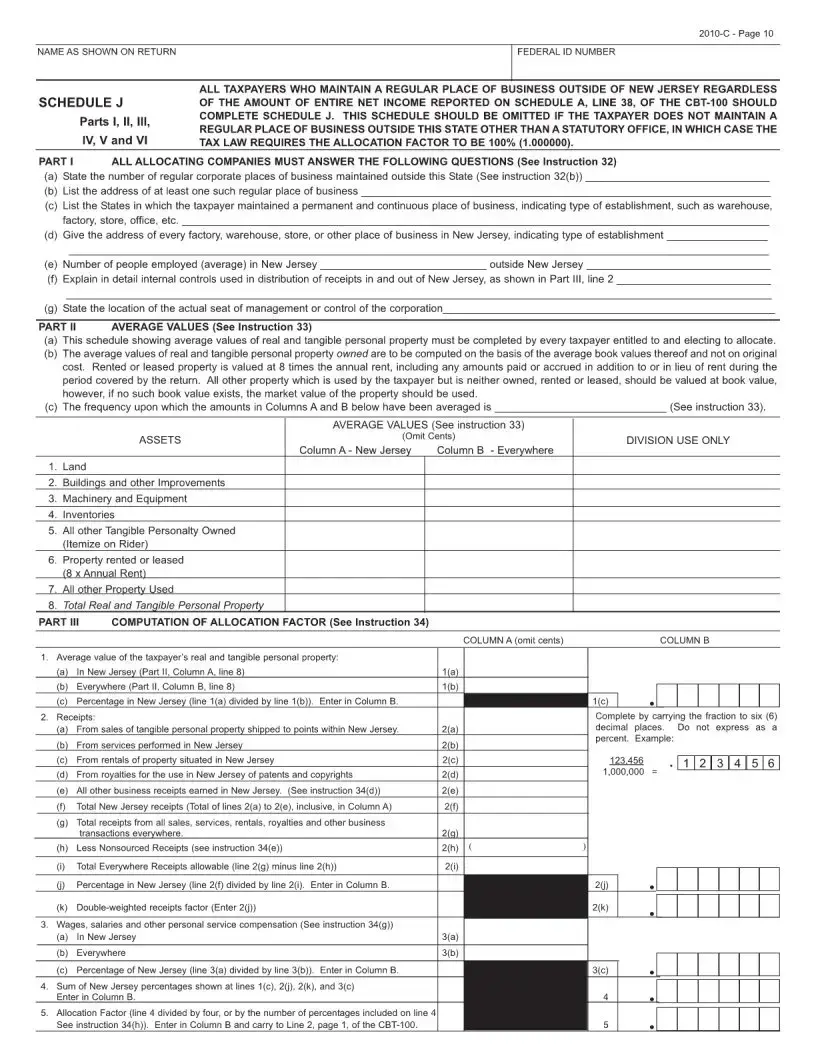

The New Jersey CBT-100 form is essential for corporations operating within the state to report their business income and calculate their tax liabilities. This form is applicable to taxable years ending on or after July 31, 2010, and it requires corporations to provide specific information, including their federal employer identification number, corporation name, and mailing address. Additionally, corporations must indicate their incorporation details and federal business activity code. The form features several key sections, including the computation of entire net income, which requires corporations to detail their gross receipts, expenses, and various income sources. It also includes calculations for allocated net income, tax bases, and applicable tax rates. Corporations must account for any tax credits and payments made on their behalf, leading to the determination of the total tax liability. Finally, the form requires signatures from authorized officers, ensuring that the information provided is accurate and complete. Understanding the CBT-100 form is crucial for compliance with New Jersey tax laws and for avoiding potential penalties.

Example - New Jersey Cbt 100 Form

Form Specs

| Fact Name | Details |

|---|---|

| Purpose of the CBT-100 | The CBT-100 is a tax return form used by corporations in New Jersey to report their business income and calculate their tax liability. |

| Tax Years Applicable | This form is for taxable years ending on or after July 31, 2010, and before June 30, 2011. |

| Governing Law | The CBT-100 is governed by the New Jersey Corporation Business Tax Act, N.J.S.A. 54:10A-1 et seq. |

| Filing Requirements | Every corporation doing business in New Jersey must file the CBT-100, regardless of income. |

| Information Required | Corporations must provide details such as their federal employer ID number, corporation name, and mailing address on the form. |

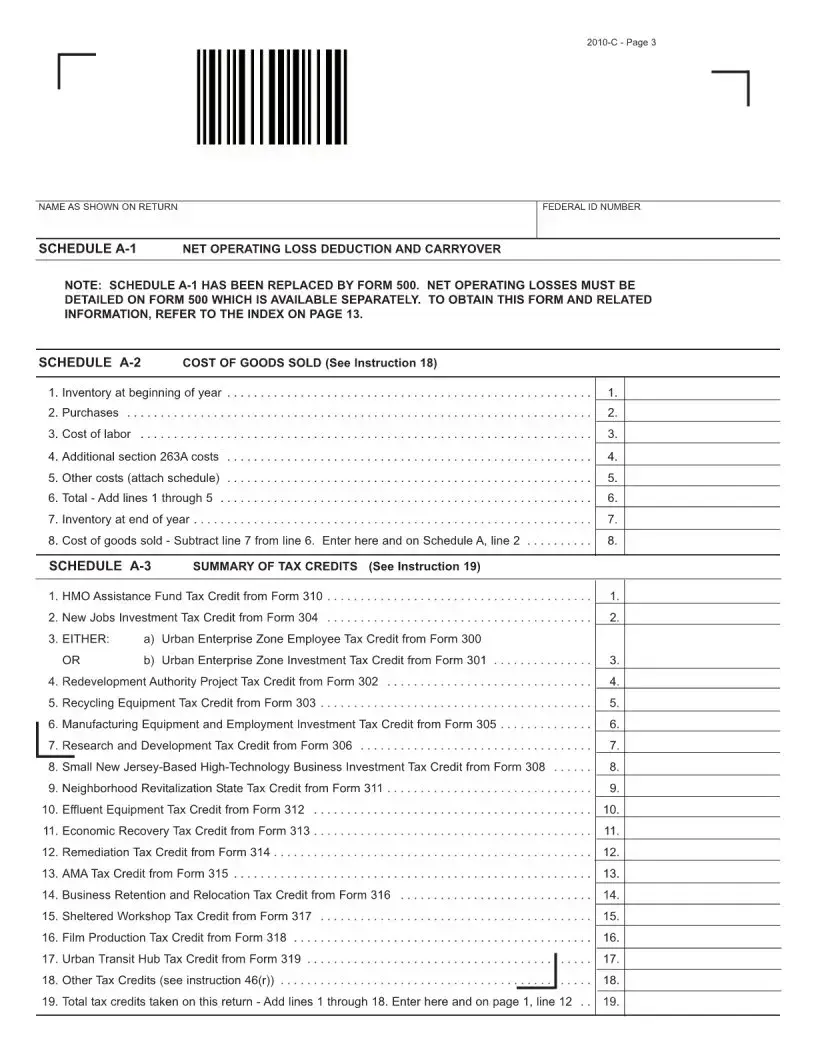

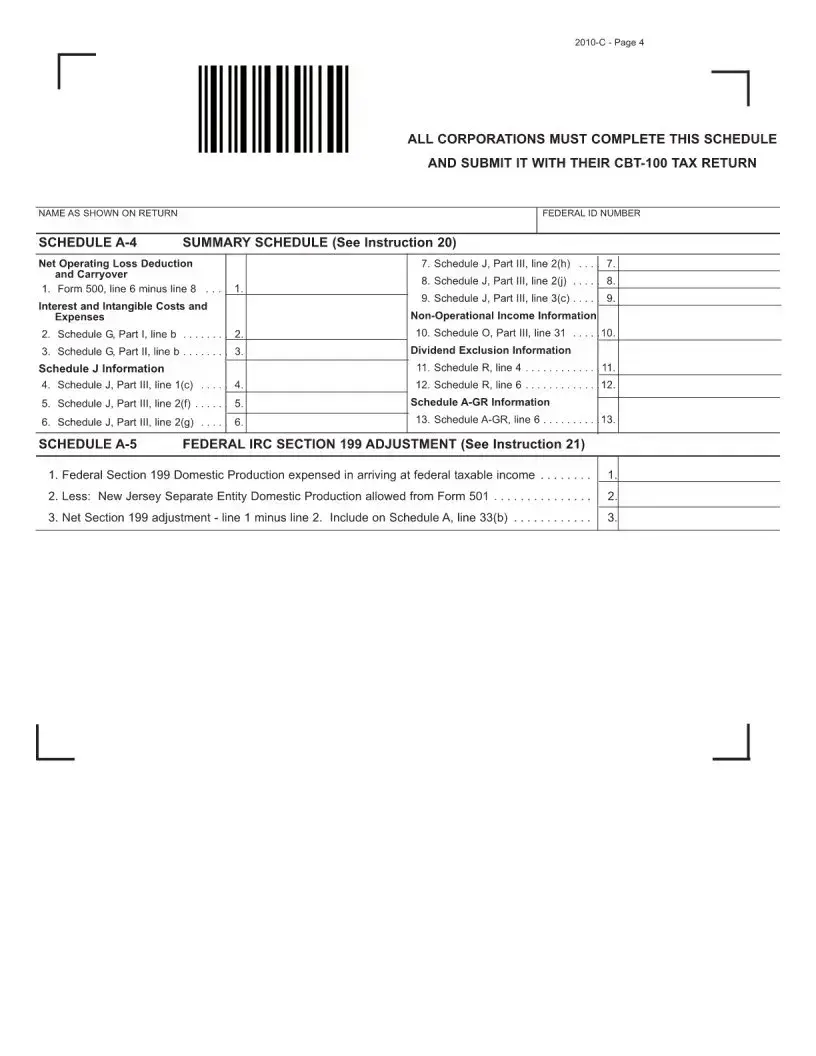

| Net Income Calculation | Corporations calculate their entire net income using Schedule A, which includes gross receipts and various deductions. |

| Tax Credits | The form allows corporations to claim various tax credits, which can reduce their overall tax liability. |

| Payment Information | Corporations must indicate any payments made, including those made by partnerships on their behalf. |

| Signatures Required | The form must be signed by an authorized officer of the corporation and, if applicable, the individual preparing the return. |

More PDF Documents

Unclaimed Money Nj - It represents a critical step in the lifecycle of unclaimed property management, from identification through to potential reunification with owners.

Filing the Texas Homeschool Letter of Intent form is an essential step for families who choose to educate their children at home, as it formally informs the state of Texas about their homeschooling plans. To ensure that you are following the necessary guidelines and to simplify the process, you can refer to the detailed instructions available at hsintentletter.com/texas-homeschool-letter-of-intent-form. Understanding the form's requirements will offer clarity and peace of mind to parents on this educational adventure.

Complaint Letter to Landlord - A crucial step in the New Jersey eviction process, this form can also address issues beyond non-payment of rent.