Fill in a Valid New Jersey Ppt 6 B Template

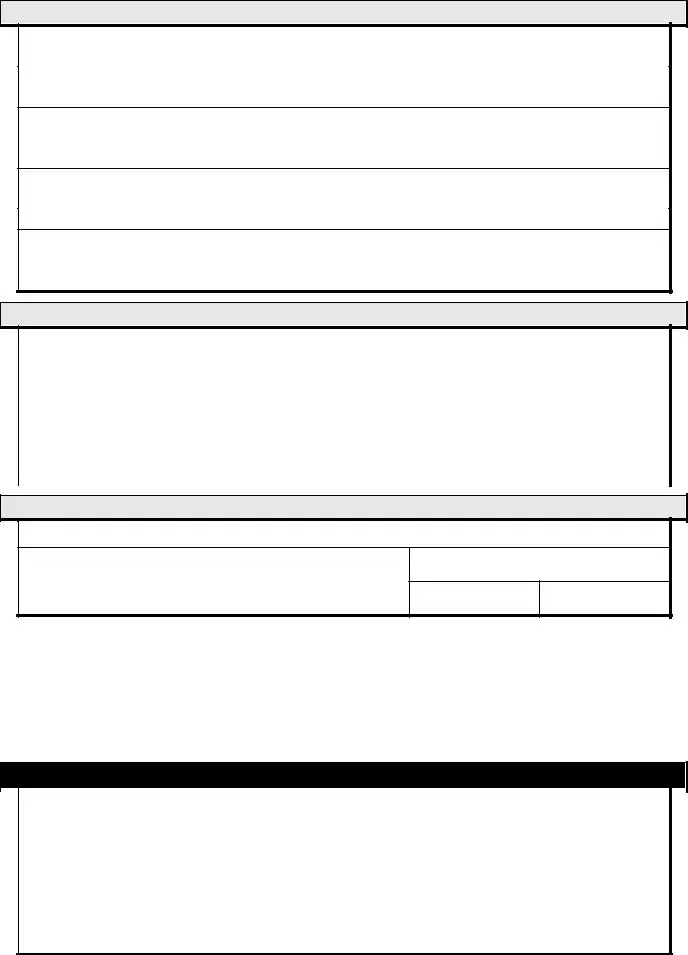

The New Jersey PPT 6 B form plays a crucial role for businesses involved in the petroleum products industry. This form is part of the Petroleum Products Gross Receipts Tax registration process and is essential for obtaining a Direct Payment Permit. By completing the PPT 6 B, businesses provide vital information, such as their company name, federal tax ID number, and business type, which includes options like corporation, sole proprietorship, and limited liability company. The form also requires details about the owners or responsible parties, ensuring that those who hold significant ownership stakes are identified. Additionally, businesses must outline their activities, intended suppliers, and customers, which helps the state understand the nature of their operations. One of the key benefits of the Direct Payment Permit is that it allows holders to purchase petroleum products without incurring immediate tax charges, as they will pay the tax directly to the state later. However, eligibility for this permit is contingent on the applicant's business model and the likelihood of tax burdens affecting consumers. Completing the form accurately is essential, as any inaccuracies could lead to denial or revocation of the permit. Therefore, understanding the nuances of the PPT 6 B form is vital for businesses aiming to navigate the regulatory landscape of New Jersey's petroleum industry.

Example - New Jersey Ppt 6 B Form

Divisio n Use O nly

— DLN Sta mp —

Divisio n Use O nly

— Da te Sta mp —

|

|

|

|

|

|

|

Pe tro le um Pro duc ts G ro ss Re c e ipts Ta x |

||||||

|

|

Fo rm PPT- 1 |

|

|

|||||||||

|

|

|

|

|

Re g istra tio n Fo rm & |

|

|

|

|

|

|||

|

|

Re p la c ing |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Ap p lic a tio n fo r Dire c t Pa yme nt Pe rmit |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Pa rt 1: Busine ss Info rm a tio n |

|

|

|

|||

|

|

|

C o mp a ny Na me |

|

|

|

|

|

Fe d e ra l Ta x ID Numb e r |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Tra d e Na me |

|

|

|

|

|

Da te Busine ss in NJ Be g a n |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Physic a l Ad d re ss |

|

|

|

Ma iling Ad d re ss |

|

|

|

|||

|

|

|

|

|

|

|

|

||||||

|

|

|

C o mp a ny We b site Ad d re ss |

|

Ema il Ad d re ss fo r Po int o f C o nta c t |

|

|||||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Pe rso n to C o nta c t Re g a rd ing This Ap p lic a tio n |

Title |

|

|

Pho ne Numb e r |

|

|||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

Busine ss Typ e (c he c k o ne ) |

|

|

|

|

|

|

||||

|

|

|

C o rp o ra tio n |

|

So le Pro p rie to rship |

Pa rtne rship |

LLC |

|

LLP |

|

|||

|

|

|

Disre g a rd e d Entity |

|

O the r (sp e c ify): |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||||

|

|

|

Prio r o wne r (if p urc ha sing a n e xisting b usine ss) |

|

|

Ne w Je rse y Ta x ID Numb e r |

|

||||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Ad d re ss, C ity, Sta te , Zip |

|

|

|

Pho ne Numb e r |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pa rt 2: O wne rs / Re spo nsib le Pa rtie s Info rm a tio n

|

Atta c h rid e r if ne e d e d . |

Inc lud e C o rp o ra te O ffic e rs a nd b usine sse s o r ind ivid ua ls o wning 10% o r mo re o f the c o mp a ny. |

||

|

Na me |

|

FEIN / SSN |

|

|

|

|

|

|

Ad d re ss

% o wne rship / title

Na me

FEIN / SSN

Ad d re ss

% o wne rship / title

Na me

FEIN / SSN

Ad d re ss

% o wne rship / title

Na me

FEIN / SSN

Ad d re ss

% o wne rship / title

Pa rt 3: Busine ss Ac tivitie s

De sc rib e yo ur b usine ss mo d e l a nd re g ula r a c tivitie s

List yo ur inte nd e d sup p lie rs

List yo ur inte nd e d c usto me rs

List the p ro d uc ts yo u inte nd to se ll

Pa rt 4: Applic a tio n fo r Dire c t Pa ym e nt Pe rm it

Ho ld ing a Dire c t Pa ym e nt Pe rmit e ntitle s the ho ld e r to p urc ha se p e tro le um p ro d uc ts witho ut b e ing c ha rg e d the ta x. The Dire c t Pa yme nt Pe rmit ho ld e r will p a y the ta x d ue d ire c tly to the sta te fo r a ny sa le o r use o f a p e tro le um p ro d uc t.

|

The |

Divisio n o f Ta xa tio n issue s Dire c t p a yme nt Pe rmits to |

e ntitie s who will ha ve a size a b le p ro p o rtio n o f e xe mp t |

|||||||

c usto me rs o r who will fre q ue ntly e nc o unte r situa tio ns in whic h the ta x will b e c o lle c te d mo re tha n o nc e . |

|

|

||||||||

|

The |

Divisio n o f Ta xa tio n ma y no t issue a Dire c t Pa ym e nt Pe rmit if d o ing so will inc re a se the |

ta x b urd e n to |

the |

||||||

ultima te c o nsume r o r if the a p p lic a nt ha s o the r me a ns to a vo id ne g a tive ta x c o nse q ue nc e s. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This b usine ss re q ue sts a Dire c t Pa ym e nt Pe rm it. |

|

|

|

This b usine ss o nly |

ne e ds |

to re g iste r fo r |

the |

|

|

|

|

|

||||||

|

|

|

|

|

|

Pe tro le um Pro duc ts |

G ro ss |

Re c e ipts Ta x. |

No |

|

|

|

|

|

|

|

|

Dire c t Pa ym e nt Pe rm it is re q ue ste d a t this tim e . |

|||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Pa rt 5: Affirm a tio n

The sig na to ry a ffirms tha t a ll info rma tio n c o nta ine d in this re g istra tio n a nd a ny a tta c he d d o c ume nts is c o mp le te a nd true . Any inc o mp le te o r inc o rre c t info rma tio n c a n re sult in d e nia l o f this a p p lic a tio n o r re vo c a tio n o f the p e rmit.

Sig na ture o f o wne r o r a utho rize d o ffic e r |

Printe d Na m e |

Title

Da te

Se nd this c o mp le te d re g istra tio n/ a p p lic a tio n to :

Exc ise Ta x Bra nc h

Divisio n o f Ta xa tio n

PO Bo x 189

Tre nto n, NJ 08695- 0189

Ema il it to :

fue l.ta x@ tre a s.sta te .nj.us

THERE IS N O FEE FO R THIS A PPLIC A TIO N .

Sho uld yo u ha ve a ny q ue stio ns re g a rd ing this re g istra tio n/ a p p lic a tio n, p le a se c a ll the Exc ise Ta x Bra nc h a t (609)

Divisio n Use O nly – De te rm ina tio n

|

|

|

The a p p lic a nt is re g iste re d fo r the PPG RTa s o f |

Inve stig a tio n sta rt d a te : |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

The a p p lic a nt re c e ive d a DPP e ffe c tive o n |

Inve stig a tio n e nd d a te : |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

The a p p lic a tio n fo r DPP wa s d e nie d . |

Inve stig a te d b y: |

|

|

|

|

|

||

|

|

|

|

|

|

Inve stig a to r’ s sta te me nts:

Form Specs

| Fact Name | Description |

|---|---|

| Governing Law | The New Jersey PPT-6-B form is governed by NJSA 54:15B-1 et seq., which outlines the Petroleum Products Gross Receipts Tax. |

| Purpose | This form is used to apply for a Direct Payment Permit, allowing businesses to purchase petroleum products without being charged tax. |

| Application Process | Applicants must provide detailed business information, including ownership structure and intended business activities. |

| Tax Responsibilities | Holders of the Direct Payment Permit are responsible for paying the tax directly to the state for any sale or use of petroleum products. |

| Contact Information | For questions regarding the application, contact the Excise Tax Branch at (609) 633-9057 or email fuel.tax@treas.state.nj.us. |

More PDF Documents

Nj State Tax Form 2023 Pdf - Allows for easier record-keeping and auditing of tax-exempt sales, ensuring legal compliance.

How to Become a Private Investigator in Nj - Employers are required to complete portions of the form, attesting to the applicant's duties and reasons for employment termination.

To effectively manage legal and financial responsibilities, consider utilizing a reliable document for Power of Attorney management. This form will empower you to designate an individual to handle your affairs as per your wishes.

Perc Mediation - An administrative form enabling New Jersey public employers or employees to challenge or verify the legitimacy of union representation.